Tell Breww where you are registered to pay tax (Nexuses)

Sales tax nexus is the connection between a seller and a state that requires the seller to register, then collect and remit sales tax in the state. Certain business activities, including having a physical presence or reaching a certain sales threshold, may establish nexus with the state.

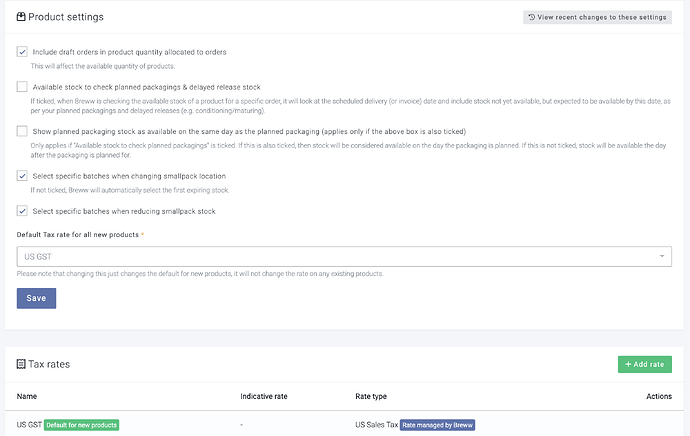

For US sales tax calculations, Breww will automatically assume you are registered in your home state. However, you must check that this has been correctly applied. You can check and amend this by navigating to Settings → Product settings.

Then you will see the screen and options below:

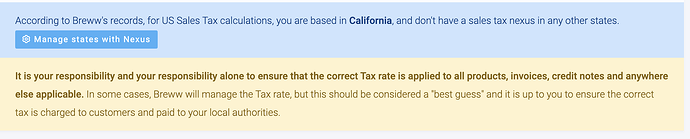

Then, scroll to the bottom of the page and using the Manage stats with Nexus button, select the states you are registered in.

You will then see the following dropdown.

How much tax will be charged?

Breww keeps a database of all state, county, city and district taxes and, when using our managed “US GST” tax rate, will use this database (and where you have Nexus) to determine the tax rates that apply to any sale. We update this database very regularly and endeavour to keep it free from mistakes/errors; however, it’s your responsibility to check that the correct rates are being applied.

Each product in Breww is linked to a tax rate. This can be our managed “US GST” rate (where the actual rate percentage depends on who is buying the item), or one that you manage yourself with a fixed rate that you define.

You can use the Add rate button to add manually configured tax rates if you don’t want to use Breww’s managed tax rates.

Which customers will be charged tax?

For tax to be charged at all, Breww needs to know if the customer is exempt or not. This can be set on a per-customer basis, or set for many customers at once by being set on their “Customer type”. More on how this works can be read in our dedicated guide on this topic - How to set which customers have to pay VAT/GST/Sale tax

Disclaimer

Disclaimer

Nothing in this guide should be considered tax or legal advice in any way.

This article is purely a guide on how to configure Breww to work for you. It’s your responsibility to ensure that you are familiar with the tax rules applicable to you and no tax advice should be gleaned from this article in relation to the right tax rate to apply to any given sale, or anything else.

You’re also responsible for checking that Breww has applied your intended tax rates correctly. If you see anything that you don’t understand, please ask us. Breww Ltd cannot be held in any way responsible for any incorrectly charged tax amounts, anything else related or any repercussions as a result of incorrectly reported/charged tax amounts.